Where there is data, there is storage. As we all know, semiconductor memory has the characteristics of small size and fast storage speed, which can be widely used in server, PC, smart phone, automobile, Internet of things, mobile storage and other fields.

In the future, memory chips are a long-term high-growth track. Because the birth and explosion of new terminals or applications will drive the demand for data storage is growing. The memory market has seen several cycles of new terminal or application-driven growth, such as the penetration of the PC in the 1990s, the penetration of feature computers and the introduction of the iPod in the 2000s, the penetration of smartphones and the explosion of cloud computing in the 2010s.

In recent years, driven by 5G mobile phones, servers, PCS and other downstream demand, memory chip market scale will expand rapidly. Data show that in the downstream market of DRAM in 2020, computing, wireless communication, consumer and industry account for 45.9%, 36.5%, 9.6% and 4.5% respectively, while in the downstream market of NAND Flash, computing, wireless communication, consumer and industry account for 54.8%, 34.1%, 6.1% and 2.6% respectively (Note: In IDC's category, "Computing" includes servers and PCS, and "wireless communications" includes smartphones.) The 5G upgrade of smart phones will increase the capacity of individual smart phones, and the development of cloud computing and AI will drive up the storage demand. In addition, from 2020 to now, the COVID-19 pandemic has brought changes in working and living styles, and many applications of remote services have continued to drive demand for servers, while shipments of tablets and laptops have also increased significantly due to demands for remote working and teaching. The downstream market development will drive the rapid development of DRAM and NAND Flash.

More notably, with the advancement of autonomous driving and the introduction of in-vehicle infotainment systems (IVI), multi-camera vision processing, long-life batteries, and ultra-fast 5G networks, the data flow in and out of the car has greatly increased, and super-large computing processing has become a necessity. Accordingly, the demand for large capacity data cache (DRAM, SRAM), storage (NAND) and other storage (NOR Flash, EEPROM, etc.) has increased significantly.

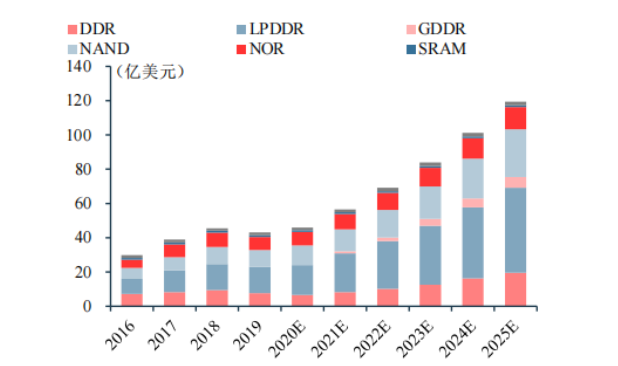

According to statistics, in 2020, the global on-board storage market scale is about 4.6 billion US dollars, accounting for less than 5% of the overall storage market, but the growth rate is relatively high, with a compound growth rate of 11.4% from 2016 to 2020. It is expected that with the improvement of automobile intelligence level, the on-board storage market will accelerate its growth. This is mainly reflected in the rapid growth of DRAM(especially LPDDR for new energy vehicles), NAND and other demands. The on-board storage market will reach $5.66 billion in 2021 and $11.94 billion in 2025, with a compound growth rate of 21.0% from 2021 to 2025. In terms of structure, the on-board storage market is dominated by DRAM and NAND, accounting for 57% and 23% respectively. Other memory chips such as NOR Flash, SRAM and EPROM/EEPROM are also widely used in the vehicle. It is not difficult to predict that with the increasing demand for data storage driven by intelligent vehicles, the on-board storage market is expected to accelerate growth.

In addition, as the level of autonomous driving improves, more and more sensors will be used to collect data about vehicle operation and surrounding environment, including cameras, millimeter-wave radar, Lidar, etc., and network communication functions such as OTA(over-the-air download technology) and V2X(Vehicle-to-everything) will also generate a large amount of data. Intel estimates that self-driving cars will generate 4,000 gigabytes of data a day. Even low-level autonomous vehicles require a lot of on-board data storage. Because cockpit IVI systems are increasingly being paired with larger, higher-resolution screens. According to China's Flash memory market forecast, L4 and L5 cars will be equipped with more than 40GB of DRAM and more than 3TB of NAND Flash, which is much higher than current smart phones. Currently, there is huge room for improvement in single-vehicle DRAM and NAND Flash capacity.

From the perspective of the domestic market, the domestic memory chip demand is huge, the market size exceeds 1/3 of the world, but the self-supply rate is less than 5%. According to IDC, China's semiconductor market share increased from 12.2% in 2005 to 36.6% in 2020, ranking first in the world. In 2020, the market size of memory chips (including DRAM and NAND) in China will be $42.9 billion, accounting for 30% of the semiconductor market size in China and 35% of the global memory chip market.

Throughout the rise of the memory chip industry in Japan and South Korea, the industry background, emerging industry demand and policy support are the necessary conditions for the development of the memory industry. At present, the global semiconductor industry is transferred to China, and China has established a complete and comprehensive industrial chain system of electronic systems. Apart from traditional consumer electronics scenarios such as PCS and mobile phones, many emerging markets such as the Internet of Things, AI, smart cars and cloud computing are also emerging. Therefore, huge domestic demand and emerging applications have provided a foundation for the development of domestic memory chip manufacturers, and the localization of supply chain under policy support can provide a boost for them.

In terms of market competition pattern, there is still a gap between domestic memory chip manufacturers and international giants in the field of bulk products. In the field of niche products, the localization level is higher. It is understood that in the aspect of DRAM, the process iteration speed has slowed down significantly in recent years, and the mainstream large-plant process remains at the 10nm+ stage, which creates opportunities for domestic manufacturers to narrow the technology generation gap. At present, Hefei Changxin 19nm process has been successfully mass produced, and 17nm process will be launched soon. In NAND Flash, the process evolution is relatively slow, and the number of 3D stacking layers increases rapidly. Yangtze River Storage has realized the mass production of 128-layer 3D NAND in 2021, which is about one year behind the international big factories, narrowing the gap significantly. At the same time, in terms of niche storage, Zhaoyi Innovation has become the third largest manufacturer in the world, with a market share of about 20% in 2021. In addition, Beijing Junzheng, Dongxin Shares, Puran Shares, Juchen Shares, etc., are also developing rapidly.

High performance and low power consumption are the two major trends in memory chip performance upgrading. According to the current demand situation of emerging applications, it is expected that the future demand for memory chips will enter the next growth cycle of 5G and AI, and driven by automobile intelligence will usher in greater market demand, and the development space of domestic memory chip manufacturers will also be expanded.